Making Sense of UK Taxation for Businesses: An Overview

Introduction to taxes

Tax; even the word seems… well, taxing. The bane of people’s existence and yet a lifeline for many. It can fill someone with rage or make them feel they are contributing to something greater. However, I’m not here to tell you my opinion, I’m here to tell you the facts.

Wherever you stand, whoever you are, you will have to pay some form of tax. Sometimes, you might not even know you’re paying tax at all. All governments around the world charge their citizens and corporations tax in many, many forms. They provide funds to run the country, build the hospitals or pay the teachers’ salaries. Maybe even your salary? In the UK, there are many different types of tax, most of which are summarised below.

If you are starting a business or are readying yourself to pay tax, it’s a good idea to get yourself familiarised with the different kinds of tax imposed on an individual or a company. This article will look at company taxes. Personal taxes can be found here.

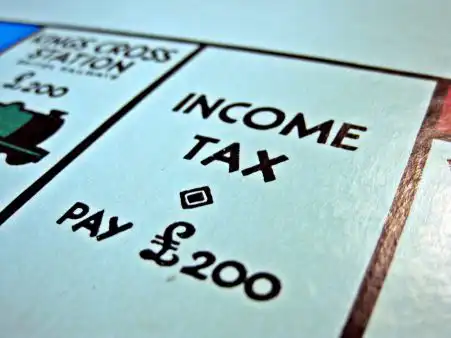

Corporation tax

Corporation tax is chargeable on limited companies, both private and listed businesses. It is the main source of taxation for companies in the UK. A company’s taxable profits are not necessarily the same as their accounting profit. This is because of certain allowances, such as capital allowances and non-allowable expenses for tax purposes such as depreciation. If a company doesn’t make a profit, then it can use losses from previous years to reduce future taxes due.

Company profits are taxed at a rate of 19%. However, from April 2023, the UK corporation tax rates will change.

Companies with profits under £50,000 will still be taxed at 19% which will be known as the small profits rate. Companies with profits over £250,000 will be taxed at the main rate of 25%. If a company’s profits are between £50,000 and £250,000 will be taxed on a sliding scale using marginal relief.

VAT

VAT or Value Added Tax, is a tax charged by VAT registered companies on any goods or services they sell. Any company can apply to become VAT registered but if a company’s turnover is over £85,000 in any 12-month period, then they are obligated to become VAT registered.

The rate of VAT charged is usually 20%, but can be 5% or 0% for certain goods or services.

VAT registered companies can also reclaim the VAT that they have been charged by other companies. For example, their fuel receipts or supplies. This essentially means that VAT charges are passed down the supply chain until someone who is non-VAT registered buys something, usually, the end consumer.

VAT that is collected by a company is then paid over to HMRC on a monthly, quarterly or annual basis. So, does this make every VAT registered company a glorified tax collector? Probably. There are multiple benefits and pitfalls when it comes to becoming VAT registered that I will discuss on a separate blog.

If it pleases you to do so, feel free to read HMRC’s VAT guidance.

National Insurance

Hang on! Isn’t it only individuals paid National Insurance? Well, they do. But so do companies that have employees. Every employee (including directors) that are paid through PAYE (pay as you earn) will earning over a certain amount incur a charge for the company that employs them. Most companies are entitled to the employment allowance of £5,000, meaning that most small companies don’t pay any National Insurance. The table below shows what is payable for individuals and companies.

| National Insurance class | Who pays | Tax Rate |

| Class 1 | Employees under State Pension age – they’re automatically deducted by your employer. Earnings £242 up to £967 per week, or £823 to £1,048 per month. Over £967 per week or 4,189 per month | 12% 2% |

| Class 1A or 1B | Employers pay these directly on their employee’s expenses or benefits Earnings £175 or £758 per month and above. | 13.8% |

Summary

So, there you have it, the taxes that a company is likely to pay at some point in its existence. Hopefully this little introduction into the various types of tax has been enlightening and educational, whether you have just started out or realised that you should have thought on it a little more, you can now rest in the assurance that you now know what taxes you may be liable for and figure out how much you need to pay.

If you would like to discuss your needs in greater depth, why not get in touch for a free, no obligation consultation.

Looking for an Accountant?

Contact us for accounting support! Simply fill out the form below, and our team of qualified accountants will be in touch with you soon.