Navigating UK Personal Taxes: What You Need to Know About 6 Common Taxes

Introduction to taxes

Tax; even the word seems… well, taxing. The bane of people’s existence and yet a lifeline for many. It can fill someone with rage or make them feel that they are contributing to something greater. However, I’m not here to tell you my opinion, I’m here to tell you the facts.

Wherever you stand, whoever you are, you will have to pay some form of tax. Sometimes, you might not even know you’re paying tax at all. All governments around the world charge their citizens and corporations tax in many, many forms. They provide funds to run the country, build the hospitals or pay the teachers’ salaries. Maybe even your salary? In the UK, there are many different types of tax, most of which are summarised below.

If you are starting a business or are readying yourself to pay tax, it’s a good idea to get yourself familiarised with the different kinds of tax imposed on an individual or a company. This article will look at personal taxes. Company taxes can be found here.

Personal taxes

A note on “personal taxes“

Each UK tax resident is entitled to a personal allowance. That is an amount you can earn before you pay any tax. The UK has a relatively generous personal allowance which for the 2022/23 tax year is £12,570. This can be made up of any income an individual makes, for example, employment income, property income, dividends and self-employment.

There are a few other allowances that I will discuss in a future blog.

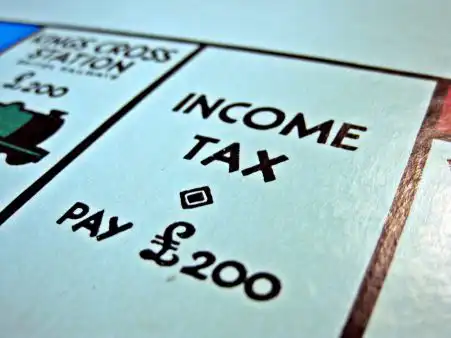

Income tax

The basis of many taxes in the UK around the amount of money you earn. Income tax is exactly as the name suggests – you are taxed on your income. The majority of people earn their money through paid employment. Their income is taxed at source, meaning that it is deducted from their pay. If you are self-employed, have property or received other income in the year, you will pay your income tax once you have filed your annual self-assessment tax return.

The rates of income tax are progressive depending on your level of income.

| Band | Taxable income | Tax rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £150,000 | 40% |

| Additional rate | over £150,000 | 45% |

National Insurance

Originally devised by the government to support unemployment, pensions and eventually fund the NHS, National Insurance is very similar to income tax but works slightly differently. The most recent change is the 1.25% uplift in National Insurance at the start of the 2022/23 tax year to further fund the NHS and equivalent bodies. As of the 6th November, this will be reversed so the NI uplift no longer applies.

Unlike income tax – and most other taxes – National Insurance is regressive, meaning that those who earn more pay a smaller percentage. Moreover, those over the state pension age do not pay National Insurance

There are a number of different classes of national insurance and your trading status has an impact on which type you pay.

| National Insurance class | Who pays | Tax Rate |

| Class 1 | Employees under State Pension age – they’re automatically deducted by your employer. Earnings £242 up to £967 per week, or £823 to £1,048 per month. Over £967 per week or 4,189 per month | 12% + 1.25% uplift 2% + 1.25% uplift |

| Class 1A or 1B | Employers pay these directly on their employee’s expenses or benefits Earnings £175 or £758 per month. | 13.8% + 1.25% uplift |

| Class 2 | Self-employed people earning profits of £6,725 or more a year. If you’re earning less than this, you can choose to pay voluntary contributions to fill or avoid gaps in your National Insurance record | £3.15 per week |

| Class 3 | Voluntary contributions – you can pay them to fill or avoid gaps in your National Insurance record | £15.85 per week |

| Class 4 | Self-employed people earning profits of £9,881 up to £52,270 per year Over £52,270 per year | 10.25% 3.25% |

Dividend tax

The profits (after corporation tax is paid – see below) of a public or private company can be distributed to the its shareholders (owners), this is known as a dividend. If you’re a shareholder in a public or private company and are paid dividends, you will be subject to dividend tax.

The first £2,000 in dividends is tax free.

Basic rate tax payers pay 8.75%

Higher rate tax payers pay 33.75%

Additional rate tax payers pay 39.35%

If you keep stocks and shares in an ISA, then this is tax free.

Capital gains tax

CGT is the tax paid on any profit made on the sale of something you own that has increased in value. A typical example is a second home or a piece of art.

The Capital Gains tax-free allowance is:

£12,300 – this is separate from your personal allowance.

£6,150 for trusts

You will only pay the tax on the profit you made, not the sales value.

You do not pay capital gains tax on your main home unless it has been rented out at some point.

Capital gains is a very complex area of tax and many different allowances exist.

Inheritance tax

A slightly morbid topic, ever wondered what happens to your stuff when you die?

When you die, your belongings – or your estate – will be taxed before it is passed onto those who inherit your stuff.

If the value of your estate is over £325,000 you will be taxed on everything above this value at a whopping 40%.

There are reliefs available, for example, if you leave some to charity.

Council tax

Anyone over the age of 18 living in a property is potentially liable to pay council tax. Council tax funds certain council services such as police and fire services, libraries, waste collections. There is usually a fixed amount to pay each year depending on which ‘Band’ you are in and your local council.

Each band is labelled from A to H and is dependent on the price of the property as if it had been sold on the 1st April 1991. A being the lowest and H the highest band.

Summary

As you can probably see, there are many ways that the local and national governments of the UK raise funds in order to spend our taxes to run the country, whatever your opinion on how well this is done, does not negate the inevitability of paying taxes that are due. There are several more taxes that businesses and corporations are charged and you will find this article here.

Looking for an Accountant?

Contact us for accounting support! Simply fill out the form below, and our team of qualified accountants will be in touch with you soon.